Journey into the Bitcoin OTC Badlands

November 2018

For the past year, our crypto team, made up of brokers, partners, introducers and connectors spread out globally in HK, LA, NY, Zug, Bristol, London, Seoul, Singapore, Tokyo and Beijing have been working hard to bring forward cryptocurrency buyers and sellers for our clients, who are looking for large volumes of Bitcoin-OTC.

This is what we have learned

While there are legitimate buyers/sellers, there is also a truly mind-boggling amount of bad actors, scams and fraud out there. From photoshopped proof-of-funds and smartphone videos of easily faked proof of coins, illegally obtained coins, money launderers, it is an absolute minefield to navigate your way through. A lot of our family office clients were looking to us to better understand how to buy or sell Bitcoin safely and securely, however, there was always a massive amount of distrust on both sides of the transaction, buy or sell.

There are a lot of OTC escrow providers in the space, however many of them are so new, it's hard to justify to an investor group or funding partner that working with such a new entity is entirely safe, despite obvious expertise and robust trading frameworks.

Too many cooks

When you have a broker chain that is more than 1, you've got problems, inevitably when there are too many claims in a chain the transaction never ever closes. Maximum should be one layer, seller, or buyer mandate or preferably working directly.

The interest level to buy Cryptocurrencies is higher than we realised - many family offices and UHNWI groups are simply not making a lot of noise about entering the market, perhaps for fear of Bitcoin bottoming out. A lot of the interest in the crypto space is being driven by the younger generations who are taking the reins of the family office affairs.

One thing that became clear was that not many family offices wants to put forward one of the family personally to get involved with a transaction, in a face to face capacity. They would rather work with a concierge service, where buyer and seller don't meet and it's managed securely and confidentially. That way they can make a decision together, and then can be helped to execute on that.

What we can see the clearest is that regulation is needed, despite that being in obvious conflict with the differing visions for cryptocurrencies. However, there is a real need to safeguard against the many risks involved with large volume BTC trades, especially if an investor is green and entering the space for the first time.

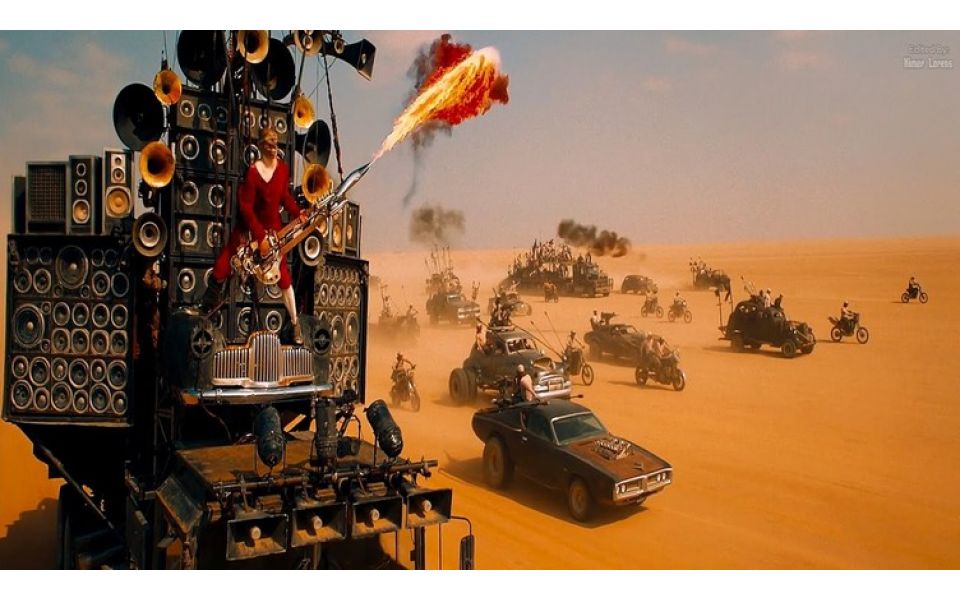

Ultimately it's been a fantastic experience, where we have met with some incredibly talented individuals who are working very hard to demystify and de-risk crypto trading and sales. There are a lot of real buyers and sellers out there so with the correct level of due diligence and risk mitigation it's possible to make buying or selling cryptocurrencies not a total car crash horror show, which is nice.

After a lot of trial and error, we have established strong partnerships with four regulated companies in London, Singapore and two in Zug, to provide a white glove service for our clients.

We have also begun working as an introductory broker for a securities company, allowing us to bring forward direct buyers and sellers to transact with a fully authorised and regulated platform.

It took a while but the journey was illuminating, terrifying and hilarious in equal measures so time well spent. With all transactions, there is a need to be flexible and review everything case by case, the number one rule in crypto - don't trust anyone in crypto is sadly pretty solid advice, especially if new to the sector.

If you want to find out more about our crypto services or need help with a trade you can check out our crypto section here:

https://www.fundsurfer.com/bitcoin-crypto

Stay up to date

Get our occasional newsletter featuring fundraising news, hints and tips, and our favourite projects